When it comes to sprucing up a home, many homeowners face a common dilemma: how to fund those fabulous renovations without breaking the bank. Enter home improvement loans, the financial fairy godmother that can transform dreams into reality—if you can navigate the maze of interest rates.

Table of Contents

ToggleOverview of Home Improvement Loans

Home improvement loans offer financial solutions for homeowners looking to renovate. These loans cater to a variety of projects, such as kitchen upgrades, bathroom remodels, and energy-efficient installations. Many lenders provide options tailored to specific needs and budget levels.

Interest rates form a crucial part of home improvement loans. They can differ based on several factors, including credit scores, loan amounts, and loan terms. Generally, borrowers with higher credit scores benefit from lower interest rates, making their loans more affordable.

Several types of home improvement loans exist. Personal loans provide unsecured financing, allowing homeowners to borrow without collateral. Home equity loans also serve as options, enabling individuals to leverage their property’s value for funding. FHA 203(k) loans specifically cater to renovation needs, offering government-backed financing to eligible borrowers.

Shopping around for various loan products proves essential. Comparing interest rates from multiple lenders helps homeowners find the best deals. Additionally, understanding the terms and conditions of each loan type assists borrowers in making informed decisions.

Determining the right loan amount is equally important. Homeowners should evaluate their renovation costs and budget constraints carefully before borrowing. Assessing potential increases in property value can provide insights into whether a loan investment is worthwhile.

Choosing the ideal loan can significantly impact overall renovation costs. By selecting a low-interest rate home improvement loan, homeowners can save substantial amounts over time. The right financing option facilitates achieving renovation dreams without financial strain.

Understanding Interest Rates

Interest rates play a pivotal role in home improvement loans. They can significantly impact overall costs associated with renovations.

How Interest Rates Are Determined

Lenders evaluate several factors to determine interest rates. Credit scores hold significant weight, with higher scores often resulting in lower rates. Loan amounts also influence rates, as larger loans may attract different pricing. Terms of repayment contribute to the calculation, with shorter terms usually providing lower interest options. Market conditions affect interest rates as well, fluctuating based on economic indicators and overall demand for loans. Borrowers must actively monitor these variables to secure the best possible rates.

Types of Interest Rates Available

Home improvement loans feature various types of interest rates. Fixed rates remain consistent throughout the loan duration, providing predictable monthly payments. Variable rates, on the other hand, can change based on market conditions, potentially offering lower initial rates. Some lenders offer promotional rates, typically lower than standard rates for a limited time. A few loans may include interest-only payment options initially, easing financial pressure during renovations. Understanding these alternatives allows homeowners to make informed borrowing decisions.

Factors Affecting Interest Rates for Home Improvement Loans

Interest rates for home improvement loans depend on several key factors. Understanding these elements helps homeowners make more informed decisions.

Credit Score Impact

Credit scores play a significant role in determining interest rates. A higher credit score typically leads to lower interest rates, allowing for more affordable payments. Lenders view individuals with strong credit histories as less risky. Consequently, these borrowers receive more favorable terms. Conversely, lower credit scores may result in higher rates, increasing overall loan costs. Homeowners can improve their credit scores through timely bill payments and reducing outstanding debt. A solid score not only enables access to better rates but also enhances borrowing flexibility.

Loan Amount and Term Length

Loan amounts and term lengths also influence interest rates. Generally, larger loans may carry higher rates due to increased risk for lenders. However, this isn’t a hard rule; some lenders offer competitive rates for substantial amounts. Shorter loan terms often lead to lower rates, given reduced risk over a smaller timeframe. Conversely, longer terms might come with higher rates to account for extended repayment periods. Homeowners should weigh their renovation budgets against potential interest rate implications. Carefully considering these factors aids in selecting the ideal loan structure for home improvement projects.

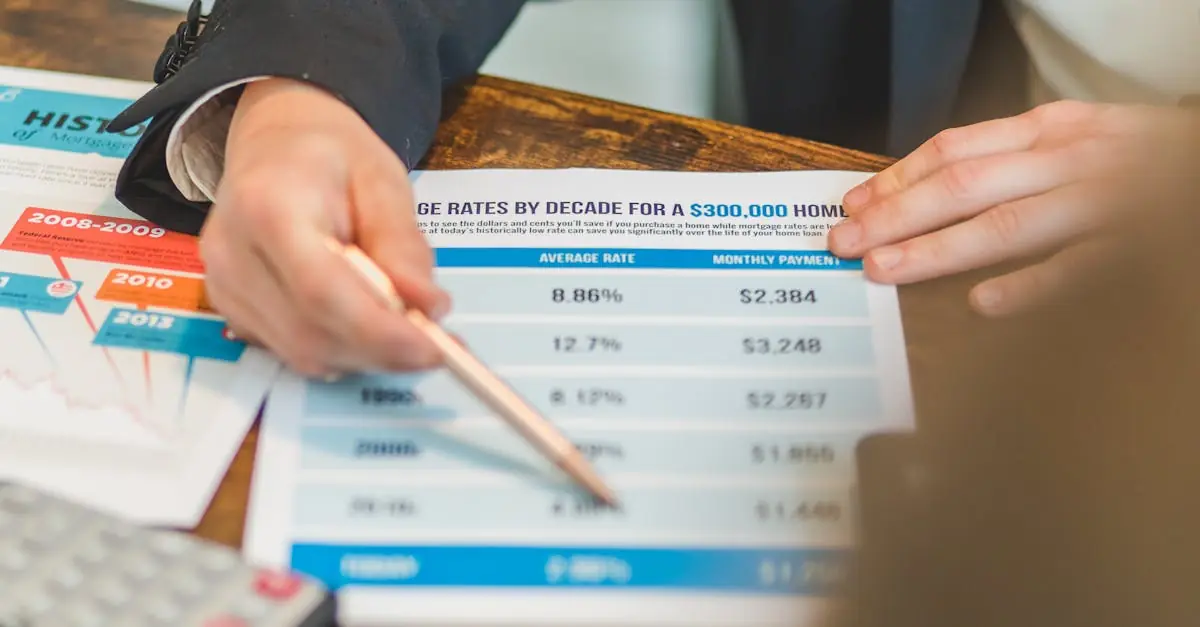

Comparison of Current Interest Rates

Interest rates for home improvement loans vary widely based on several factors. Understanding these differences helps homeowners make informed financial choices.

Fixed vs. Variable Interest Rates

Fixed interest rates remain constant throughout the loan term, allowing for predictable monthly payments. Homeowners often prefer this stability when budgeting for renovation projects. In contrast, variable rates fluctuate with market conditions, potentially offering lower initial rates. However, they carry the risk of increasing over time, making it crucial to assess the long-term implications. Borrowers should consider their risk tolerance when deciding between the two options. A lower initial rate on a variable loan may entice some, but future rate hikes could lead to unexpected costs.

Regional Variations in Interest Rates

Regional differences impact the interest rates available for home improvement loans. Economic factors, housing demands, and local lending practices contribute to these variations. For instance, metropolitan areas might offer competitive rates due to higher demand for loans. Conversely, rural regions may see higher rates owing to fewer lending options. Homeowners should research local lenders to find the best possible deals, as they may differ significantly from one region to another. Seasonal changes can also influence rates, adding another layer of complexity to the borrowing landscape.

Tips for Obtaining the Best Interest Rates

Securing the best interest rates for home improvement loans requires strategic planning and informed decision-making. Homeowners can enhance their financing options by following a few crucial steps.

Improving Your Credit Score

Improving a credit score significantly influences the interest rates available for loans. Timely bill payments represent one effective strategy for enhancing creditworthiness. Reducing outstanding debt further supports credit improvement, with a lower credit utilization ratio yielding better scores. Checking credit reports regularly allows homeowners to identify and fix errors promptly. Additionally, maintaining established credit accounts contributes positively to credit history. As scores rise, lenders may offer more favorable loan terms and lower interest rates.

Shopping Around for Loans

Shopping around for loans remains essential for obtaining competitive interest rates. Comparing offers from various lenders helps homeowners identify the best deals available in the market. Online calculators can provide quick estimates of monthly payments across different loan options. Understanding each lender’s terms, fees, and repayment schedules allows for better decision-making. Engaging with local banks and credit unions may yield personalized service and potentially lower rates. Homeowners should consider prequalification processes, as these can provide insight without impacting credit scores. Ultimately, thorough research equips individuals with the knowledge needed to secure the most advantageous loan terms.

Understanding interest rates for home improvement loans is crucial for homeowners looking to finance their renovation projects. By grasping how these rates are determined and the factors influencing them, individuals can make informed decisions that align with their financial goals.

Shopping around for the best rates and comparing different loan options can lead to significant savings over time. Homeowners should focus on improving their credit scores and evaluating their budget to ensure they choose the right loan structure.

With the right approach and thorough research, achieving renovation dreams becomes a feasible reality without incurring unnecessary financial burdens.