In the world of home improvement, interest rates can feel like that friend who always shows up uninvited—sometimes a little too high, and other times surprisingly low. With homeowners eager to transform their spaces into personal sanctuaries, understanding these rates is crucial. After all, nobody wants their dream kitchen to come with a side of financial regret.

As the market shifts, so do the rates, and keeping an eye on them can save homeowners a bundle. Whether it’s a cozy nook or a full-blown renovation, navigating these numbers can make the difference between a project that sparkles and one that sinks faster than a poorly installed backsplash. So buckle up; it’s time to dive into the world of home improvement interest rates and discover how to make those dreams a reality without breaking the bank.

Table of Contents

ToggleUnderstanding Home Improvement Interest Rates

Home improvement interest rates play a crucial role in financing renovation projects. Homeowners should grasp these rates to make informed decisions and avoid unnecessary costs.

What Are Home Improvement Interest Rates?

Home improvement interest rates represent the cost of borrowing money to finance renovations. They often apply to personal loans, home equity lines of credit, and home equity loans. Rates can vary based on the lender and the borrower’s credit score. Typically, rates tend to be higher than traditional mortgage rates but lower than credit card interest rates. Understanding these rates helps homeowners plan their budgets effectively.

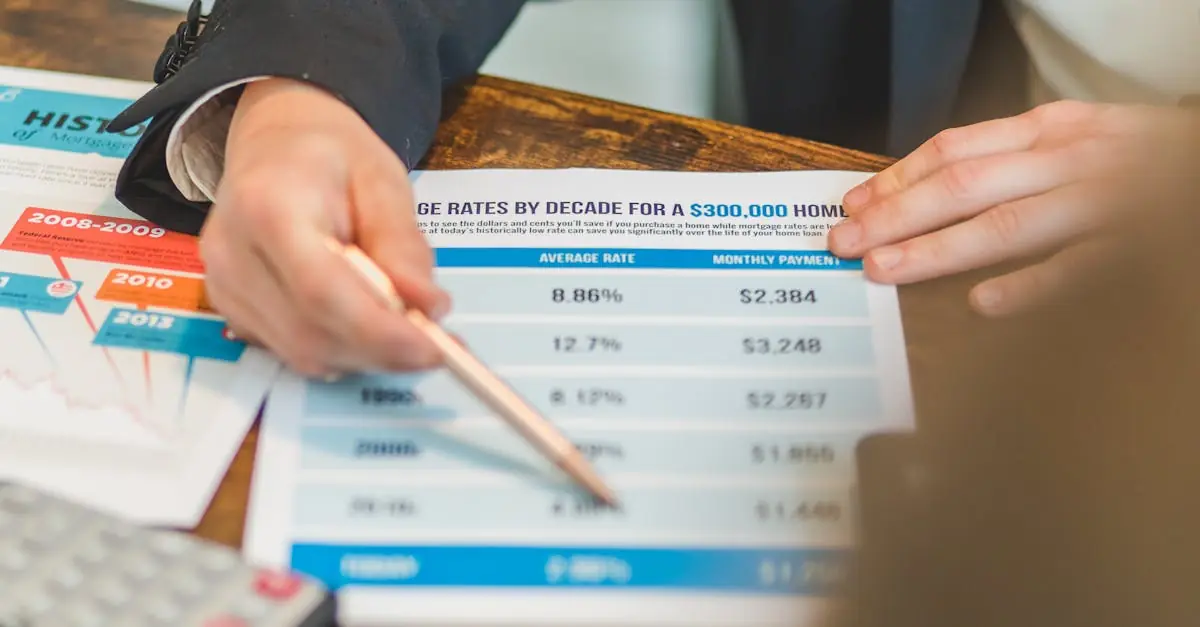

How They Differ from Standard Mortgage Rates

Standard mortgage rates typically focus on long-term home financing, stretching over 15 to 30 years. Home improvement interest rates, in contrast, often involve shorter terms and smaller loan amounts. Risk factors differ; lenders generally view home improvement loans as riskier due to their unsecured nature compared to mortgages. This difference in risk leads to varied rates. Homeowners must recognize these distinctions to choose the best financing option for their projects.

Factors Influencing Home Improvement Interest Rates

Understanding factors influencing home improvement interest rates helps homeowners make smarter financial choices. Multiple variables play a role in determining these rates.

Credit Score Impact

Credit scores significantly affect interest rates. Lenders view higher scores as indicators of reliability, leading to lower borrowing costs. For example, a borrower with a score above 740 might secure rates around 5%, while someone with a score below 680 could face rates of 7% or higher. Credit history reveals repayment behavior, impacting lender trust. Homeowners aiming for favorable rates should prioritize improving their scores before applying for loans.

Loan Amount and Term Length

Loan amounts and term lengths also shape interest rates. Lenders assess risk based on the borrowed sum and repayment duration. Smaller loans often attract higher interest rates due to perceived risk. Conversely, larger loans with longer terms might secure lower rates because they provide stable returns over time. For illustration, a $10,000 loan may come with a higher rate than a $30,000 loan. Homeowners should consider their project costs and desired loan structure when selecting the right financing option.

Types of Financing Options for Home Improvements

Homeowners can explore various financing options for their renovation projects. Understanding these choices helps in making informed decisions.

Home Equity Loans

Home equity loans allow homeowners to borrow against their property’s value. Lenders typically offer fixed interest rates, making monthly payments predictable. Homeowners can access a lump sum, providing immediate funding for large projects. Eligibility often depends on the equity built up in the property and the borrower’s credit score. Comparing terms from different lenders may reveal varying rates, highlighting the importance of thorough research.

Personal Loans

Personal loans provide an alternative for homeowners seeking flexibility. These loans may be unsecured, meaning no collateral is needed, but they often carry higher interest rates. Lenders assess creditworthiness based on credit scores and income. Homeowners can use personal loans for smaller projects, as they usually don’t require extensive documentation. Additionally, repayment terms are often straightforward, simplifying the borrowing process.

Government Programs

Government programs offer specific assistance for home improvements. Various federal and state programs provide loans or grants to eligible homeowners. Funding often aims at energy efficiency upgrades and essential repairs. Interest rates for these programs can be lower than conventional options, making them attractive for budget-conscious homeowners. Researching available programs can uncover additional financial support tailored to specific renovation goals.

Tips for Securing the Best Rates

Finding the best interest rates for home improvement funding requires diligence and research. Homeowners can significantly save on renovation projects by comparing options.

Comparing Lenders

Shop around for lenders to find competitive interest rates. Credit unions often provide lower rates compared to traditional banks. Online lenders might offer favorable terms as well, appealing to those who prefer digital solutions. Local lenders can provide personalized service and potentially more flexible options tailored to community needs. Gathering multiple quotes strengthens the negotiation position, allowing better rates to be secured.

Understanding Terms and Conditions

Study the terms and conditions associated with any loan carefully. Interest rates may seem attractive, but fees and penalties can impact the overall cost. Loan terms, including repayment periods and any potential prepayment penalties, should be clarified upfront. Flexible payment options can offer additional security should financial situations change. Carefully analyzing these details ensures informed decisions about financing home improvement projects.

Understanding home improvement interest rates can significantly impact a homeowner’s renovation journey. By staying informed about the fluctuations in these rates and the factors that influence them, homeowners can make smarter financing choices.

Exploring various funding options and comparing lenders can lead to better rates and terms. With the right knowledge and preparation, homeowners can navigate the financial landscape effectively, ensuring their projects not only enhance their living spaces but also remain financially sound. Taking the time to research and plan can turn home improvement dreams into reality without the burden of excessive debt.