Home improvement loans can feel like a rollercoaster ride—thrilling yet slightly terrifying. With interest rates bouncing around like a kid on a sugar high, it’s crucial to understand how these rates impact your renovation dreams. Whether it’s a kitchen makeover or a cozy backyard retreat, knowing the ins and outs of these loans can make all the difference between a dream home and a money pit.

Table of Contents

ToggleOverview of Home Improvement Loans

Home improvement loans serve as financial tools enabling homeowners to fund renovation projects. These loans can cover a range of updates, from minor repairs to major renovations. Various types of home improvement loans exist, such as personal loans, home equity loans, and government-backed financing options.

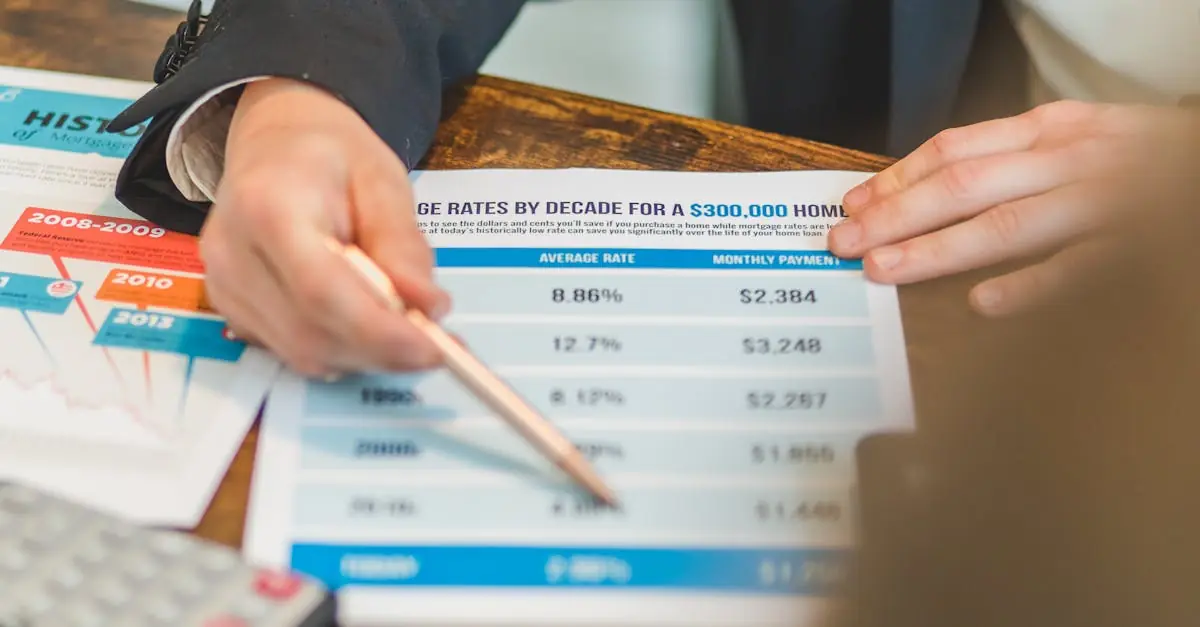

Interest rates play a crucial role in determining the overall affordability of loans. Rates can fluctuate based on market conditions, credit scores, and the loan type selected. Standard interest rates for home improvement loans typically range from 4.5% to 10%, depending on these factors.

When considering a home equity loan, homeowners should explore their current equity to understand potential borrowing limits. For instance, most lenders allow homeowners to borrow up to 85% of their home’s equity. Borrowers often assess their financial situation, taking into account existing debts and future repayment capabilities.

The application process requires thorough documentation, including income verification, credit history, and details about the project. Lenders review these factors to determine eligibility and loan terms. A well-prepared borrower can often secure lower interest rates and favorable terms.

Homeowners can maximize their returns by investing in projects that boost property value. Kitchen remodels and bathroom upgrades typically yield higher returns compared to less impactful updates. Understanding the interest rates associated with various loan options allows homeowners to make informed choices, ensuring their renovation projects align with both budget and goals.

Types of Home Improvement Loans

Various home improvement loans cater to distinct financial needs and project scopes. Homeowners should understand the differences between secured and unsecured loans to make informed decisions.

Secured Loans

Secured loans require collateral, such as the home itself. Lenders typically offer better interest rates, often ranging from 4.5% to 8%. This type of loan allows homeowners to borrow against their home equity. A common option is a home equity loan, which enables access to larger sums for significant renovations. With competitive interest rates, homeowners can make extensive improvements without overextending their finances. Approval generally involves a thorough assessment of property value and personal credit history. If homeowners default, they risk losing their home, emphasizing the need for careful financial planning.

Unsecured Loans

Unsecured loans don’t require collateral, making them attractive for many borrowers. Interest rates on these loans can vary widely, usually between 6% and 12%. Personal loans or credit cards often fall into this category, providing flexibility for smaller projects or emergency repairs. Homeowners benefit from a quicker approval process, as less documentation is needed compared to secured loans. Without risking property, borrowers maintain more control over their assets. However, higher interest rates may result in increased repayment amounts over time. Homeowners must weigh the benefits and risks before choosing this option for their renovation needs.

Factors Influencing Interest Rates

Interest rates for home improvement loans hinge on several key factors. Understanding these components helps homeowners navigate their borrowing options effectively.

Credit Score

Credit scores play a pivotal role in determining interest rates. Higher scores typically yield lower rates, as they indicate responsible borrowing behavior. Lenders assess this score to evaluate risk; a score above 700 often secures a favorable interest rate. Conversely, scores below 650 may face higher rates, reflecting a greater perceived risk. Improving a credit score through timely payments or reducing debt can lead to more attractive loan terms over time.

Loan Amount and Term

Loan amounts and terms also significantly impact interest rates. Larger loans may carry slightly higher rates due to increased risk for lenders. Furthermore, short-term loans often feature better rates compared to their long-term counterparts. Many lenders prefer immediate repayment, so they incentivize shorter terms with lower interest costs. Homeowners are encouraged to balance desired loan amounts and repayment timelines to achieve optimal rates while financing their renovation projects.

Current Trends in Interest Rates for Home Improvement Loans

Interest rates for home improvement loans fluctuate based on several factors. Current market conditions directly influence these rates, resulting in a range typically from 4.5% to 10%. Economic indicators, such as inflation and the Federal Reserve’s policy decisions, play a significant role in determining the direction of interest rates.

Credit scores heavily impact individual loan rates. Borrowers with high credit scores often secure lower rates, while scores below 650 may encounter higher rates due to increased lending risk. In assessing loan options, homeowners should focus on their creditworthiness to find the best available rates.

Loan amounts and terms also affect interest rates. Larger loans frequently come with higher rates, while shorter loan terms generally offer more competitive rates. A strategic approach in determining both the loan amount and duration can enhance savings, leading to more favorable financial outcomes.

Types of loans matter in the discussion of interest rates. Secured loans typically feature lower rates, ranging from 4.5% to 8%, as they require collateral like the home itself. Unsecured loans, on the other hand, have higher rates of 6% to 12% due to the absence of collateral.

Homeowners should consider ongoing trends in home improvement lending. Renovations that increase property value remain popular. Kitchens and bathrooms often yield higher returns on investment. Understanding interest rates associated with home improvement loans empowers homeowners to make informed choices aligned with their financial objectives.

Tips for Securing the Best Interest Rates

Understand your credit score. Higher scores lead to lower interest rates, while scores below 650 often bring higher rates due to perceived risks. Borrowers with strong credit histories generally receive better offers.

Research various loan options. Personal loans, home equity loans, and government-backed loans all have different interest rates. Homeowners can find favorable terms by comparing their choices.

Consider the loan amount and term. Larger loans might carry higher rates, but shorter terms often come with better rates. Balancing the desired loan amount and repayment timeline can help secure optimal rates.

Prepare documentation carefully. Lenders appreciate well-organized applications. It’s essential to provide detailed financial information, which can enhance borrowing opportunities.

Consult multiple lenders. Comparing offers from different financial institutions provides insight into available interest rates. Homeowners routinely uncover varied terms and rates by reaching out to multiple lenders.

Enhance property value with renovations. Investing in projects that increase home value can lead to long-term financial benefits. Kitchens and bathrooms typically yield higher returns.

Stay informed about market trends. Interest rates fluctuate based on broader economic conditions and Federal Reserve policies. Monitoring these changes can provide strategic insights for decision-making.

Utilize online calculators. These tools can assist in estimating potential loan costs and monthly payments. By gaining insight into payment structures, homeowners can better align their budgets with loan options.

Negotiate terms with lenders. It’s possible to discuss rates and terms with lenders to achieve more favorable conditions. Homeowners who advocate for better terms may secure lower interest rates.

Navigating the world of home improvement loans can be a rewarding yet challenging journey. By understanding interest rates and their implications, homeowners can make informed choices that align with their renovation goals. Whether opting for secured or unsecured loans, the key lies in assessing personal financial situations and creditworthiness.

Staying updated on market trends and exploring various loan options can lead to better rates and terms. Ultimately, strategic planning and thorough research empower homeowners to enhance their living spaces while safeguarding their financial health. With the right approach, they can transform their homes and achieve the dream renovations they’ve always envisioned.